Tax Incremental Finance (TIF)

Tax incremental financing (TIF) is a economic development / budgetary tool that allows cities and other municipalities to use the future tax revenues generated by a development project to finance the project's upfront costs.

How does TIF work?

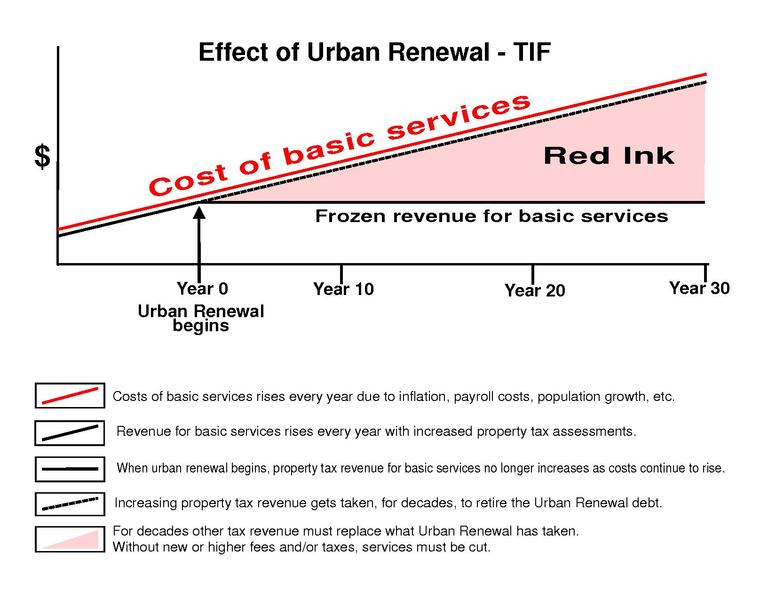

A municipality establishes a TIF district around a specific area or development project. The municipality diverts from the various taxing bodies the future tax revenues generated by the development project (incremental tax revenues) to finance the upfront costs of the project. The school district, technical college, county, and even the city all lose tax revenue to fund unbudgeted projects including things like infrastructure improvements, building construction, and other expenses.

The municipality pays back the upfront costs of the project with the incremental tax revenues generated by the project. This can be done through a variety of means, such as issuing bonds or setting aside a portion of the tax revenues for repayment. Once the upfront costs of the project have been repaid, the incremental tax revenues are returned to the municipality's general fund to be used for other purposes.

TIF is often used to stimulate economic development and revitalize distressed areas by providing financing for projects that may not otherwise be economically feasible. However, TIF has also been the subject of controversy, with some arguing that it can create inequities, shift the burden of financing development from developers to taxpayers, and create long-term debt for the municipality. Alternatively, it can be argued TIF is often used as a budgetary tool working around levy limits.